Financial Crisis

The Future of Money

What is our “financial crisis”? What will the financial future look like?

We have a basic assumption that “we the people” and the government are excessively in debt. This is probably true of almost all (major) nations in the world.

A financial crisis develops when debt can’t be paid.

What does the (fiat money based) “system” (essentially the government / Central Banks – depending on the nation they are the same thing) do about a financial crisis? They devalue the money. In other words they “print money”. In other words they create inflation.

Based on this, we can assume that we are only looking at the beginning of significant inflation for the USA (and the world).

Who gets hurt by this? Anyone lacking financial resources (essentially those who struggle for income to increase as fast as costs increase). Also “Creditors” (anyone with savings).

What doesn’t lose value? Hard assets like gold. Assets that aren’t valued in currency, for example stocks have a price per share, as the currency decreases in value the price of all shares of stock will increase in compensation for this. Keep in mind that financial people call stocks “equities”. Real estate seems like a good thing to own, except that it’s not very liquid, you can’t easily convert real estate value into buying the week’s groceries. Real estate may also fluctuate a lot in times of financial troubles.

Basically, as a private individual, not buried in debt, you want to evaluate “Will my income and assets adjust with the pace of inflation?”. Hint: savings accounts and fixed rate assets like CDs will not. Any financial institution which is paying you a higher rate of interest than the rate of inflation is at risk of going out of business (and thus a risk that you’ll lose your money). Stocks should, although the ride is likely to be very bumpy.

When does gold lose value? The conventional, simple answer is that gold doesn’t lose value. Gold retains value. However, I’m inclined to say that isn’t precisely true. The exchange rate (price) of gold will vary. What makes the price of gold vary? Primarily it is due to confidence, or lack of confidence, in the fiat money the gold is being exchanged for.

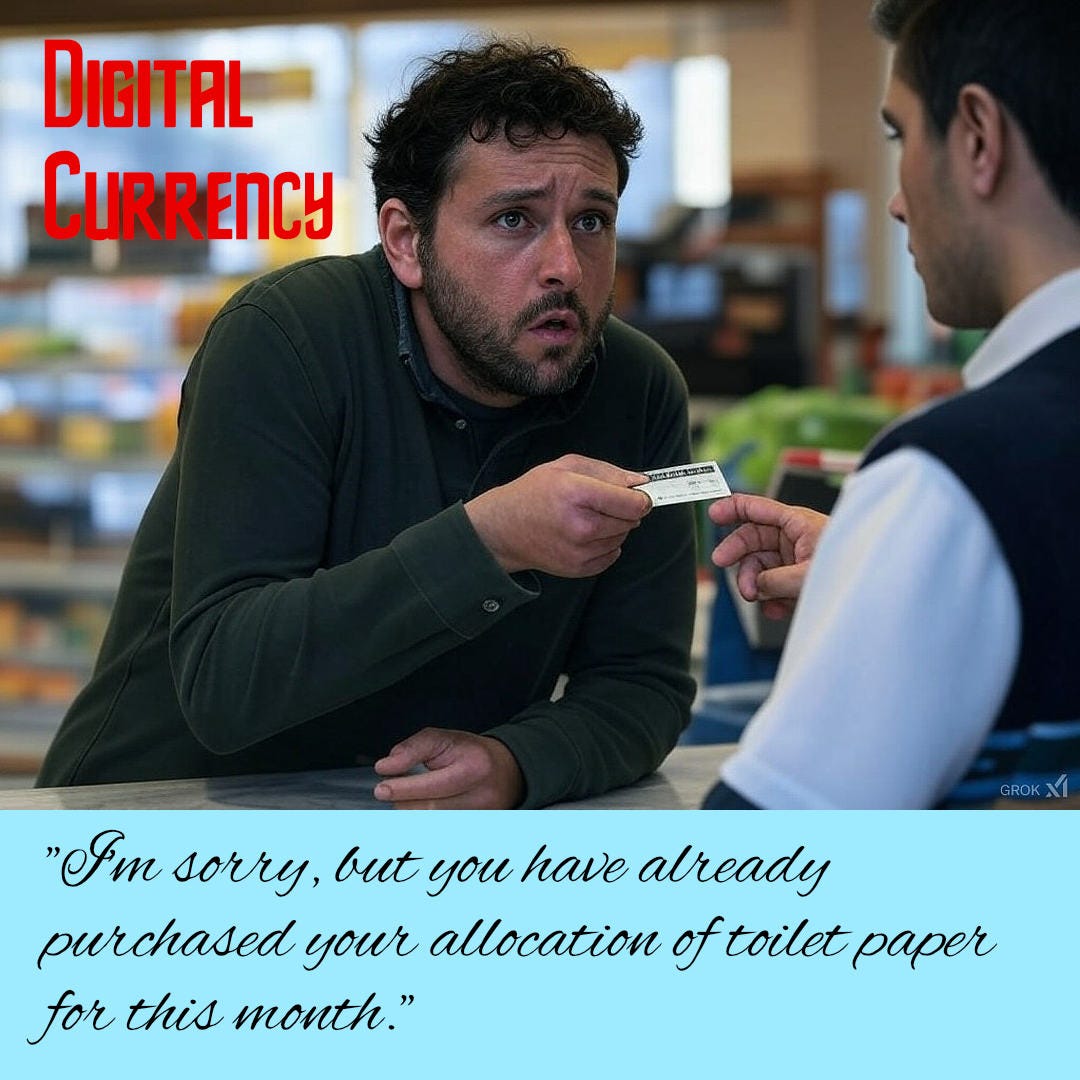

Currently we have talk of the government attempting get out of the current financial crisis by switching from dollars to cryptocurrency. That probably deserves an article of it’s own. It’s not clear how switching to digital currency would solve anything, but it sure does evoke fear of tyranny.

Because he and a few cronies caused it in order to make them all individually just a hair bit richer! Although, it does now look like there were a few other reasons for blowing things up and starting another tiff within Iraq.🫣🫢

The government is going down! Actually, they all are. They’re all broke! But, governments, operatives, politicians, banks, monarchies, banks, etc… keep telling each other we’ll pay you next Tuesday at 10:00 am. At 9:45 am….Oh hold on we’re in meetings make it noon. At 12:02 pm Oops! Another emergency happened we’ll get to it to you at 4:00 pm. At 3:52 pm Oh wait….we didn’t receive our payment from so and so or such and such so we’ll have to pay you on another day ending in Y! And, this goes on every new moon, full moon, season change, equinox shift or whatever and so on and so forth! Then they all threaten each other that they’re going to get mad and do this or that, but in reality they all sit in the corner and pout like spoiled brats!

It’s Crazy!!!!!!

However, if they do all go away the next problem is I don’t think we’re ready as a civilization to self govern. Because if we were we could give them all the boot for good! I also think people and corporations are too attached to money and power. So they won’t let go. And, most people don’t have the guts to tell them we don’t give a rats ass get in line or help out like everyone else.

Or tell them to go find ”Your Own Private ID”, actually an island or some place like the Arctic Circle, because Idaho is too beautiful!

I don’t know. Maybe I don’t have enough faith in humankind. I do truly think that all swamps need to be drained and we will get to a point where we can self govern. In contemplation it’s made me think that it’s possibly one of the reasons why many of us are here at this time in order to assist in that transition.🤷🏻♀️

(You did get that my catch phrases are all songs, right? Private ID from the B-52s and the Future and Shade comment from Tinbuck3??? Wow! I just realized they’re both from FORTY years ago. On one hand it all seems like last week. And on the other, five possibly eight lifetimes ago.)

There’s something else I forgot to mention last night in regards to crypto. Someone reminded me of it today. Most of the world doesn’t have consistent electricity 24/7, let alone computers. Hell, many communities don’t even have clean drinking water, indoor bathrooms or paved streets. How would they get anything electronic in order to get that all important score to get groceries? Most areas still pay in cash or barter.

Oh….Another thing about the biggest most inflated crypto was really really started by an alphabet agency. Just like many companies and social meeting websites that look like they were all started by pioneering heroic college dropouts were another alphabet agency experiment.

But, I’m with Schultz on that one! “I know Not-ting!”😉🙄🤣🤣

Pa…..Your findings on all the Red Light stuff has been interesting! Thank You!!!

At some point, there’s going to have to be some sort of reset. Not the globalist idiots’ reset. A reset because we’ve priced ourselves out of our own world.

There will be no crypto! Nothing to back it, and more importantly, no allocation numbers. No a saving’s account at what 2% to maybe 6% interest isn’t going to sustain anyone given our inflation rate. Nor will CD’s. I learned the hard way on that one. They’re worthless, in my opinion.

Gold, silver and other precious metals and stones will retain their value. You’re correct about real estate. It’s a great investment, but not liquid. The only reason it might go down in value is if the market is flooded with properties for sale due to possible Covvey and other jabs or other medical related deaths.

In cities right now subsidiaries of Black Rock and other corporations are scooping up properties left and right or are using some as shields to launder money. All due to the “15 minute” city theory. But, none of these companies are going to have the money to build the high rise apartment complexes where the tenants’ units are smaller than a postage stamp.

They aren’t smart enough to think like Buckminster Fuller or the guy in Florida that has designed a prototype of where people could cohabitate in something like a city in very comfortable and efficient dwellings/homes. I can’t remember the guy’s name.

We’ll see..... We can only hope somehow or some way the future becomes so bright we gotta to wear shades!😉🤞☀️😎